us germany tax treaty withholding rates

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income. Detailed description of corporate withholding taxes in Germany Notes.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

0 0 10.

. Global tax rates 2022 is part of the suite of international tax resources provided by the Deloitte International. Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. This makes it possible for instance for the IRS to see what income taxes a US.

The 15 WHT rate applies on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions. You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. Principal International Tax KPMG US.

Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same. Except for China and Singapore which apply a flat WHT rate of 75 to dividend payments and the Philippines which applies a flat WHT rate of 10 on dividends the treaty WHT rates for dividends under the post 1999 DTAs is 75 for dividends where the recipient controls at least 10 of the voting power of the Nigerian company paying the. Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021.

Germany 3 15 27 28 5 24. The purpose of the Germany-USA double taxation treaty. 7For example Art 12 of the 2003 Japan-US tax treaty provides that The provisions.

Foreign tax credits offset US. The new tax treaty replaces the treaty signed on 9 July 1962. Germany has concluded DTTs applicable for income taxes with nearly 90 countries amongst them most of the industrialised countries.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. A new tax treaty between Israel and Germany is effective as of 1 January 2017 in force since 9 May 2016.

Provisions of the existing convention permit German resident investors to make portfolio investments in the United States through United States Regulated Investment Companies RICs and receive an exemption on the income in the Federal Republic. 2021 Global Withholding Taxes. Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest.

Germany - Tax Treaty Documents. This table should not be relied on to determine whether a US. All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report.

Corporate - Withholding taxes. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced you must attach a fully completed Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701 b to your tax return. Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15 Name Code Paid by US.

The United States withholding rate on such dividend to German investors will remain at 15 percent. In fact under a 2006 amendment to the US-Germany income tax treaty the governments of both countries are allowed to share tax information with one another. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries.

Corporate recipients of dividend and interest income interest on convertible and profit-sharing bonds can apply for refund of the tax withheld over the corporation tax rate of 15 plus solidarity surcharge regardless of any further relief available under a treaty. Most importantly for German investors in the United States the Protocol would eliminate the withholding. Citizen living in Germany is paying in that country.

However DTTs have not been concluded. Up to 10 branch tax may be imposed on PE profits. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

Last reviewed - 01 February 2022. This simplified procedure is only applicable to licensors who 1 are tax resident in a treaty state ie a state with which Germany has concluded an income tax treaty eg the US 2. Oman Last reviewed 04 January 2022 Resident.

How the German-American Tax Treaty Works in Practice. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. Under the new tax treaty the following rates apply.

Germany - Tax Treaty Documents. Pakistan Last reviewed 20 December 2021 Resident. Obligors General Treaty.

Technical Explanation of the Convention. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. The complete texts of the following tax treaty documents are available in Adobe PDF format.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. The Germany-US double taxation.

61 rows In other situations withholding agents may apply reduced rates or be exempted from the requirement to withhold tax at source either under domestic law exceptions or when there is a tax treaty between the foreign persons country of residence and the United States that provides for such reduction or exemption. 15 15 0. Exemption on Your Tax Return.

15 15 15. Corporate - Withholding taxes. Other Tax Rates 2 Non-Resident Withholding Tax Rates for Treaty Countries 133 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 France 10 515 010 25 Gabon 10 15 10 25 Germany 10 515 010 025 Greece 10 515 010 1525 Guyana 15 15 10 25 Hong Kong 10 515 10 25 Hungary 10 515 010 101525 Iceland 10 515 010 1525.

German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country.

Mexico Tax Rates Taxes In Mexico Tax Foundation

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Doing Business In The United States Federal Tax Issues Pwc

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Foreign Dividend Tax Rates How To Reclaim Withholding Tax In 2022

Mexico Tax Rates Taxes In Mexico Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

Figure A4 Personal Income Tax Rates In The Eu Download Scientific Diagram

Withholding Tax Rates To Non Residents Download Table

Global Tax Rates Comparison Tax Money Havens

Withholding Tax Rates To Non Residents Download Table

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

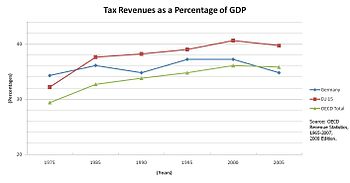

Germany Tax Information Income Taxes In Germany Tax Foundation

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic