flow through entity private equity

The current prevailing trend is to have private equity funds structured to have flexibility to own both flow-through and corporate entities. When a PE firm structures an LBO transaction some PE investors generally tax-exempt and foreign investors will invest directly or indirectly in portfolio company equity through one or more newly-formed Delaware C corporations the blocker corporation.

Open Ended And Evergreen Funds In Venture Capital Toptal

A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity.

. An entity taxed as a flow-through will generally have greater value because of the significant tax benefits and that can be afforded the purchaser than for. One reason for such restrictions is a funds need to avoid. We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt.

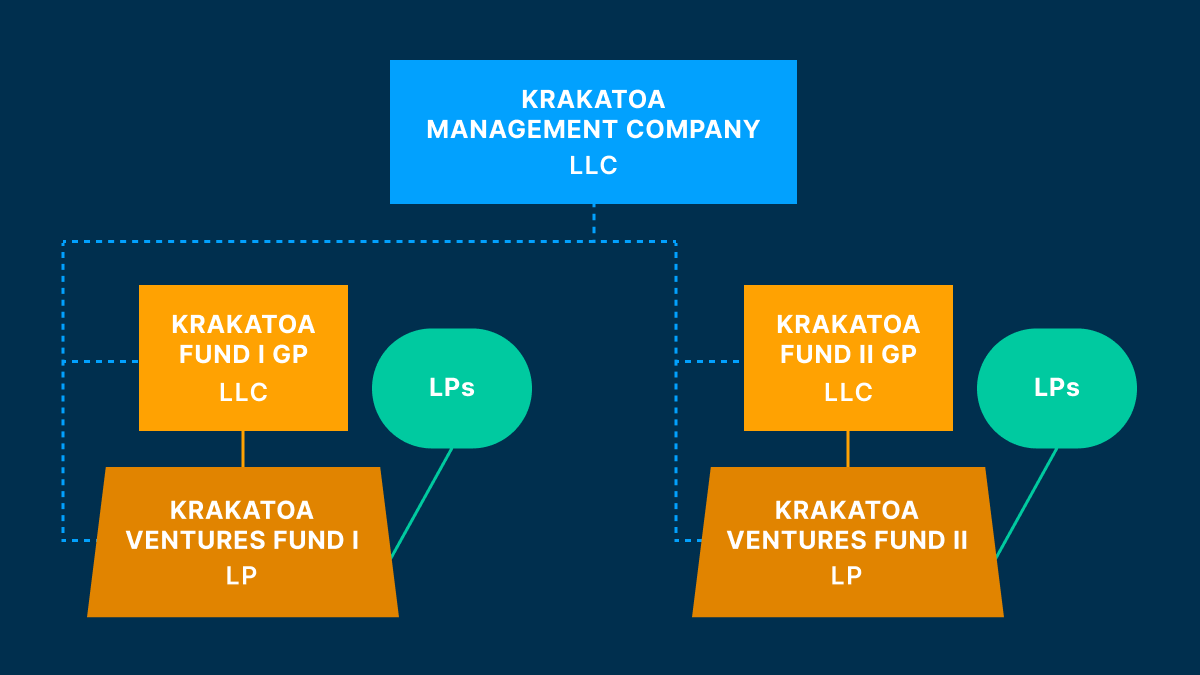

1057 Formation of Private Equity Venture Capital or Buyout Fund 113 106 HISTORY OF PRIVATE EQUITYVENTURE CAPITAL INVESTING 113. Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US. Raising a private equity fund requires two groups of people.

Planning devices can include the following. The reason for passing through income structure is that the owners otherwise get double taxed Double Taxed. In this stage of the private equity investment process flow chart the deal team typically interacts with the investment bank and the management of the target company on a daily basis.

The entity passes its total income to the entitys owners and therefore taxes are calculated on the individual basis on each and every owner. However incorrect treatment of certain tax items by the seller are. In this legal entity income flows through to the owners of the entity or investors as the case may be.

1 Financial Sponsor Sponsor in image. Blocker to exit its investment in the US. Flow-through used to be viewed as more attractive but under certain fact patterns thats not necessarily the case anymore.

Since it is a flow-through entity the owners must report their earnings as income when filing pers. Real Estate Capital Markets REITs. This is generally comprised of a General.

The team of individuals that will identify execute and manage investments in privately-held operating businesses. Flow-through portfolio company as the court decision may permit the non-US. Tax exempts and non-us.

2 LPs and LLCs are pass-through entities for federal income tax purposes. Company X is owned by two businessmen in Los Angeles. Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US.

With flow-through entities such as S corporations and partnerships past tax liabilities tend to stay with the original owners. Practically speaking a covenant to avoid UBTI means that the fund cannot incur indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. The basic financials of X are as follows.

PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. It is typical in private equity funds for certain tax-sensitive investors including us. Or other flow-through entity is attributable to the flow-through entitys interest direct or indirect in the.

Tax exempts and non-US. Venture capital funds and private equity funds typically contain significant limitations on the ability of investors to transfer their partnership interests. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US.

A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests. Investors such as sovereign wealth funds to. Structuring Newco as Flow-Through Entity 301 NEWCO AS S CORP 34 3011 Limited Liability and General Characteristics 34 30111 General 34.

Blocker corporation to hold an investment in a US. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals. Tax reform has resurrected the debate about which structure is better today.

The pass-through entity can be defined as a process by which any organization will be relieved from double taxation burden. Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities. Blocker corporation rather than a US.

Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below. Hence the income of the entity is the same at the income of the owners or investors.

Investments in qualified affordable housing projects through flow-through limited liability entities have different risks and rewards than traditional equity investments. Generally investors in qualified affordable housing project investments expect to receive a majority of their return through the receipt of tax credits and other tax benefits. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

They will send requests to the target company to address any outstanding issues such as visit requests calls with sales personnel non-executive management customers and suppliers. It is typical in private equity funds for certain tax-sensitive investors including US.

Private Equity Fund Structure A Simple Model

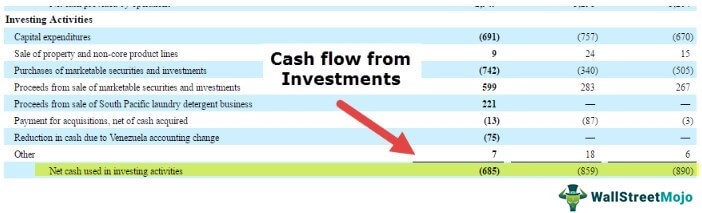

Cash Flow From Investing Activities Formula Calculations

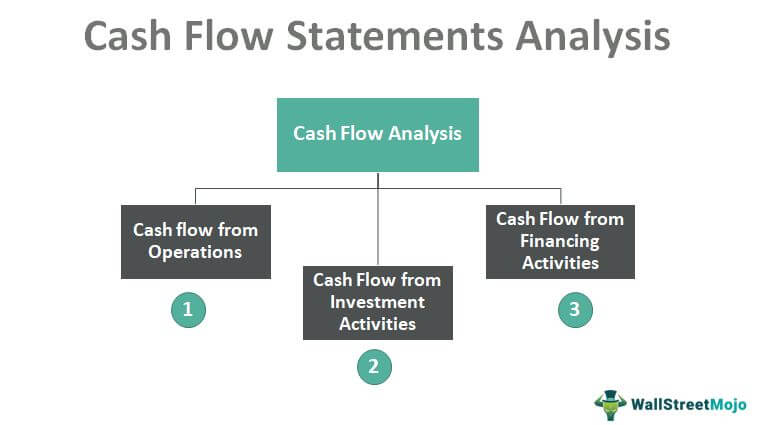

Cash Flow Analysis Examples Step By Step Guide

Developing A Private Equity Fund Foundation And Structure The Giin

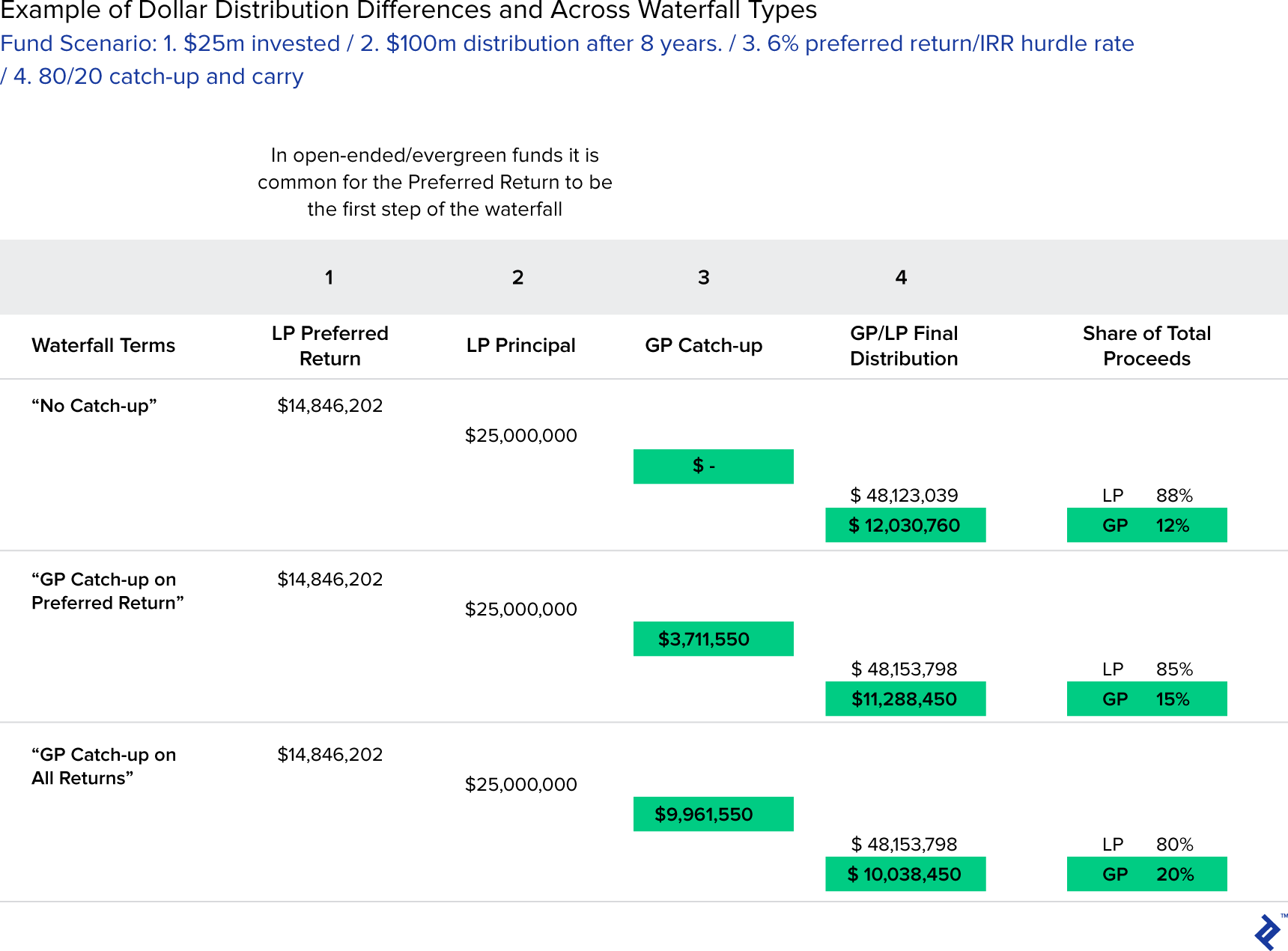

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

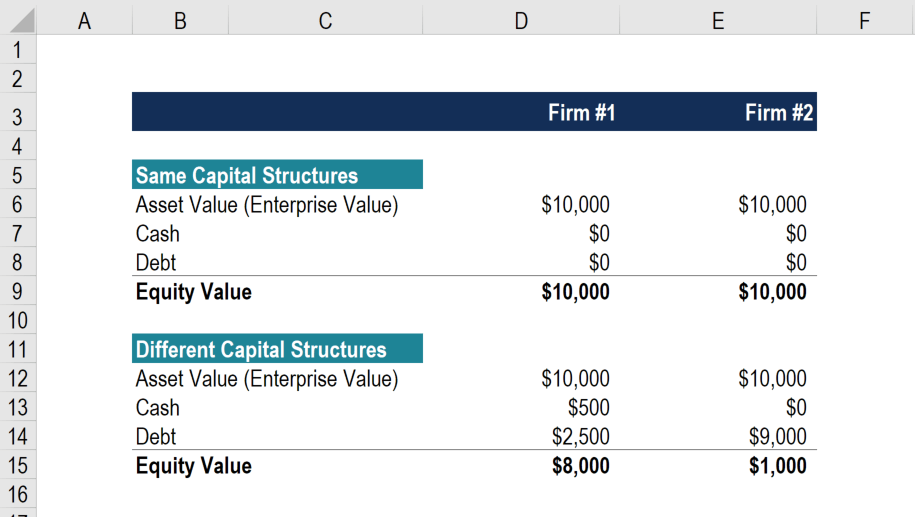

Enterprise Value Vs Equity Value Complete Guide And Examples

Real Estate Private Equity Overview Careers Salaries Interviews

/GettyImages-1156715223-b8aab9f507bf4ea3bbc73cb13319d469.jpg)

How To Become A Private Equity Associate

Open Ended And Evergreen Funds In Venture Capital Toptal

Open Ended And Evergreen Funds In Venture Capital Toptal

Distressed Buyouts Primer Distressed For Control Investing

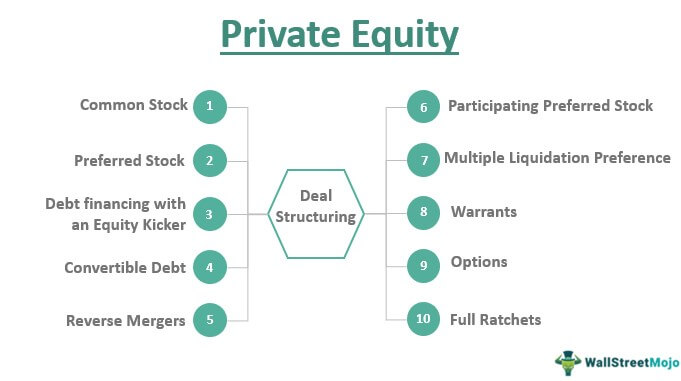

Private Equity Meaning Investments Structure Explanation

Pass Through Entity Definition Examples Advantages Disadvantages

4 Types Of Business Structures And Their Tax Implications Netsuite

Pass Through Entity Definition Examples Advantages Disadvantages

The Legal Structures Of Venture Capital Funds Carta

Real Estate Private Equity Overview Careers Salaries Interviews

/GettyImages-1148584746-b15457d168dc42a183ac41a0e95523b6.jpg)